"Empowering your potential through expert guidance"

Setisfied Clients

Team Members

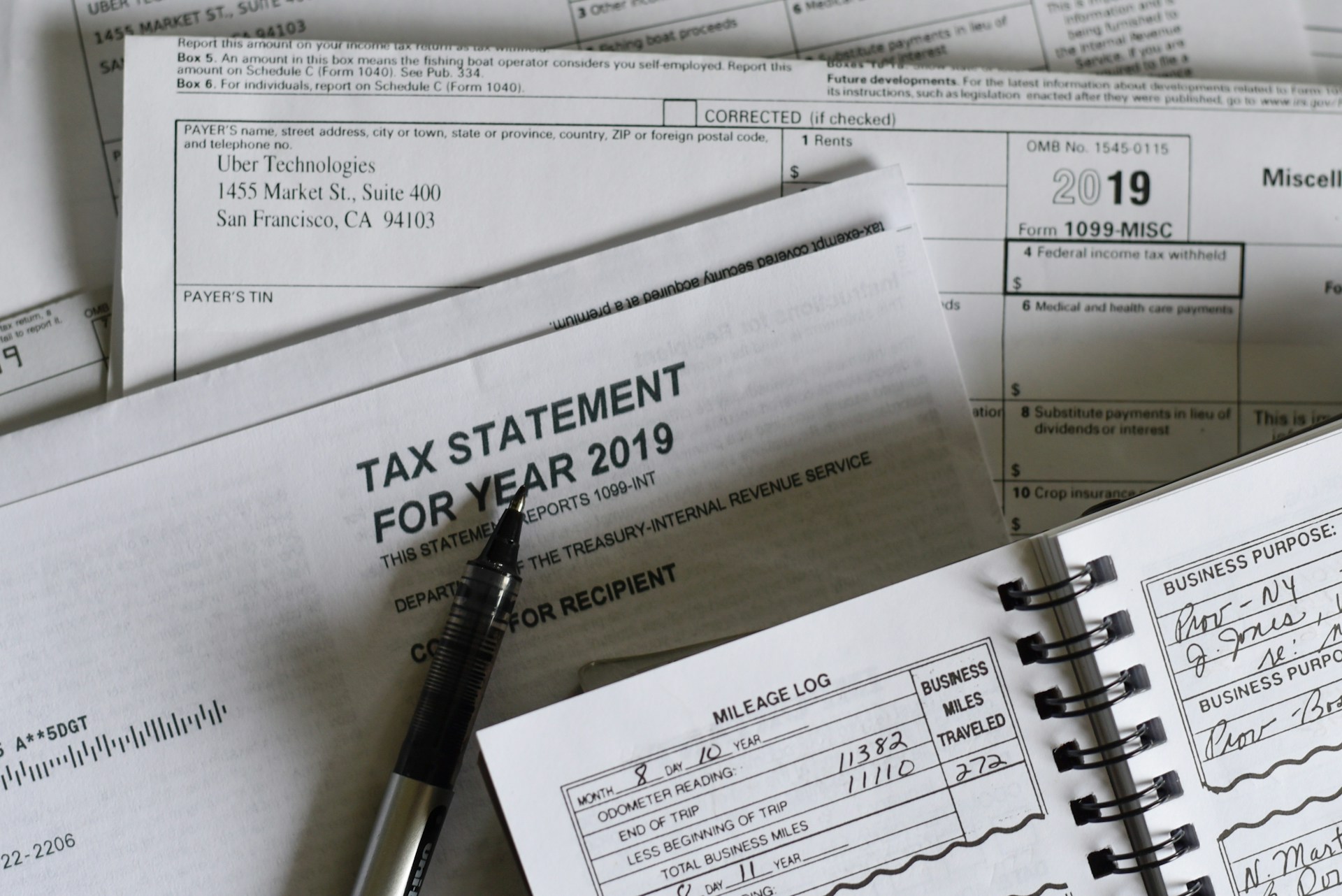

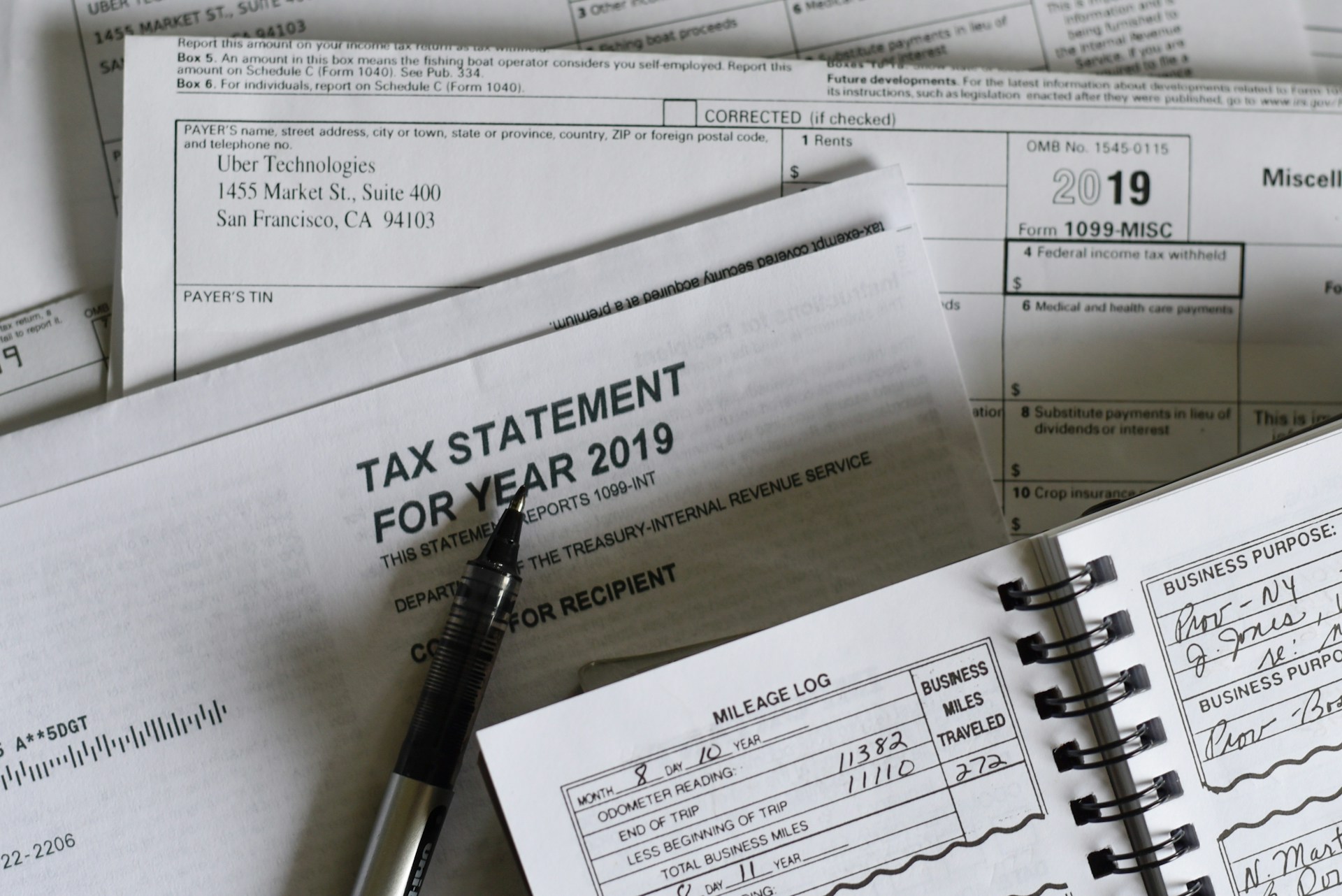

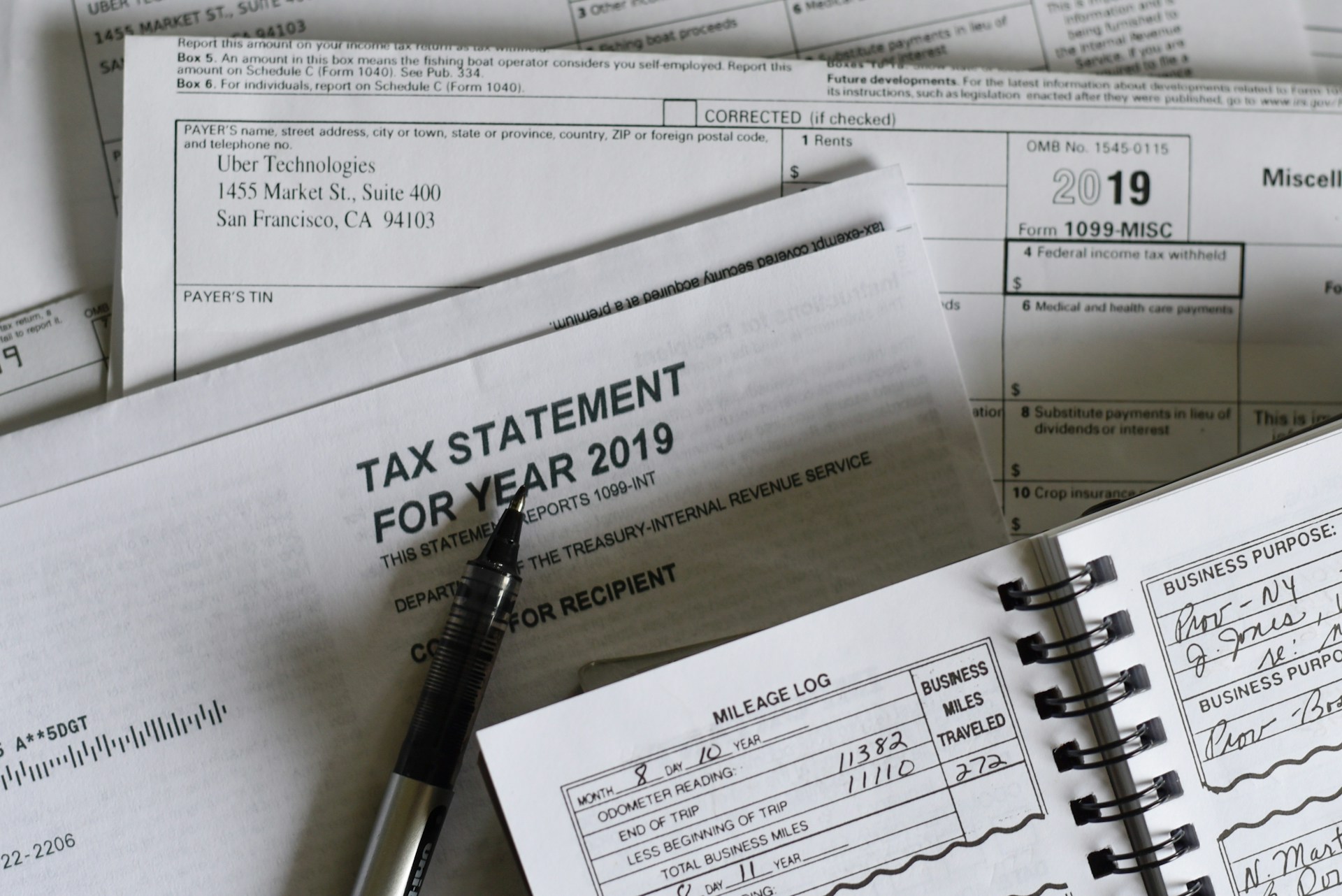

TDS and TCS are two of the most significant sources of income for the government. And, it’s crucial for businesses to make such on-time tax payments to avoid penalties and staying compliant.

Have a Query? Contact us now !

150+

50+

What is TDS & TCS?

TDS is a mechanism where the government collects tax at the source of income generation. It is applicable to various payments such as salaries, interest, rent, commissions, professional fees, etc. The deductor (payer) deducts a certain percentage of tax before making the payment to the deductee (payee). The deducted amount is then deposited with the government on behalf of the payee.

TCS is a mechanism similar to TDS but in reverse. Here, the seller collects tax at the source from the buyer when selling specific goods and services. The collected tax is then deposited with the government. TCS is commonly applied to transactions involving goods such as scrap, timber, minerals, or the sale of a motor vehicle above a certain value.

What is TDS & TCS?

TDS is a mechanism where the government collects tax at the source of income generation. It is applicable to various payments such as salaries, interest, rent, commissions, professional fees, etc. The deductor (payer) deducts a certain percentage of tax before making the payment to the deductee (payee). The deducted amount is then deposited with the government on behalf of the payee.

TCS is a mechanism similar to TDS but in reverse. Here, the seller collects tax at the source from the buyer when selling specific goods and services. The collected tax is then deposited with the government. TCS is commonly applied to transactions involving goods such as scrap, timber, minerals, or the sale of a motor vehicle above a certain value.

Benefits of TDS:

It prevents people from evasion taxes.

The burden of responsibility of the Tax Collection Agencies and the Deductor are lessened.

TDS is deducted at the time of payment, it ensures timely collection of taxes, reducing the delay in revenue collection.

It is convenient for the deductee as Tax is automatically deducted.

Frequently asked questions

What is TDS?

TDS(Tax Deducted at Source) is the tax withheld by the payer before making a payment to the payee when a transaction occurs. For example, your employer (Payer) deducts a portion as tax (TDS) from your salary before paying you (Payee). The amount deducted is then deposited with the government on your behalf. This TDS will be offset with your final tax liability. Therefore, people cannot evade taxes as the government knows their income and financial transactions, and the tax they owe is accounted for.

What is TDS Return Filing?

TDS Return Filing is the process of submitting a detailed statement to the Income Tax Department of India, which includes the details of TDS (Tax Deducted at Source) deducted and deposited by the deductor (the payer) during a particular period. This filing is mandatory for all entities (individuals, companies, partnerships, etc.) who deduct TDS. It is crucial for ensuring transparency and compliance with tax regulations.

Here's how to file your TDS return online in a simple, step-by-step manner: Visit the official e-filing portal. Click on 'Login Here.' Enter your TAN or user ID, password, and the Captcha code. Click 'Login.' Go to the 'TDS' section and choose 'Upload TDS.' In the provided form, select the relevant statement details, including the FVU version, Form name, financial year, upload type, and quarter. Click 'Validate' to check the statement details. Upload the TDS statement with your DSC (Digital Signature Certificate). Upload the ZIP file of the TDS statement. Attach a signature file. Click 'Upload.' To ensure a smooth TDS return filing process, make sure you understand the requirements for uploading TDS returns.

Employers: Any employer deducting TDS from salaries must file TDS returns using Form 24Q.

Businesses and Entities: Companies, firms, and individuals deducting TDS on payments like rent, interest, commission, etc., must file using Form 26Q.

Individuals and HUFs: Required to deduct TDS on payments like rent exceeding ₹50,000 per month, even if not running a business.

Banks and Financial Institutions: Must file returns for TDS deducted on interest paid to account holders.

Payments to Non-Residents: Entities making payments to non-residents or foreign companies must file the appropriate TDS return forms.

For late filing of TDS returns, a fee of ₹200 per day is charged under Section 234E until the return is filed, capped at the amount of TDS payable. Additionally, under Section 271H, a penalty ranging from ₹10,000 to ₹1,00,000 may be imposed for delayed filing or providing incorrect information. Interest is also charged on late payments of TDS, adding to the overall financial burden of non-compliance.

Failing to file a TDS return can result in significant penalties, including a late filing fee of ₹200 per day and a potential penalty of ₹10,000 to ₹1,00,000 under tax laws. Additionally, interest charges on late TDS payments can increase the financial burden. Expenses for which TDS was not deducted may be disallowed, leading to higher taxable income. Persistent non-compliance could also lead to legal action, impact creditworthiness, and cause issues with tax credit claims for deductees. Timely filing is crucial to avoid these consequences and ensure compliance.

TDS is deducted on the payment amount as per the rate specified in the Income Tax Act